Effective financial management is not determined solely by income level, but rather by prudent and disciplined handling of existing resources. Whether you are a seasoned investor or just beginning your financial journey, developing sound financial habits is essential for building long-term wealth.

Five Smart Financial Habits That Build Long-Term Wealth

1. Budget With Purpose

Start with a goal-oriented budget. Use tools like Excel or budgeting apps to track income and expenditures. The ’50/30/20 Rule’ is a popular framework:

• 50% – Essentials (e.g., housing, utilities)

• 30% – Discretionary expenses (e.g., entertainment)

• 20% – Savings and debt repayment

(Note: This is a commonly used method and not a prescriptive recommendation.)

2. Pay Yourself First

Set up automatic deductions on salary receipt to transfer a fixed portion to savings and investment instruments such as Recurring Deposits (RDs), SIPs, or PPF. Treat savings as a non-negotiable monthly expense.

3. Manage Debt Strategically

While not all debt is harmful, high-interest liabilities such as credit card balances can significantly erode wealth. Consider repaying such debts using the ‘avalanche method’ (highest interest first) or ‘snowball method’ (smallest balance first). Also, explore restructuring or balance transfer options offered by Indian banks.

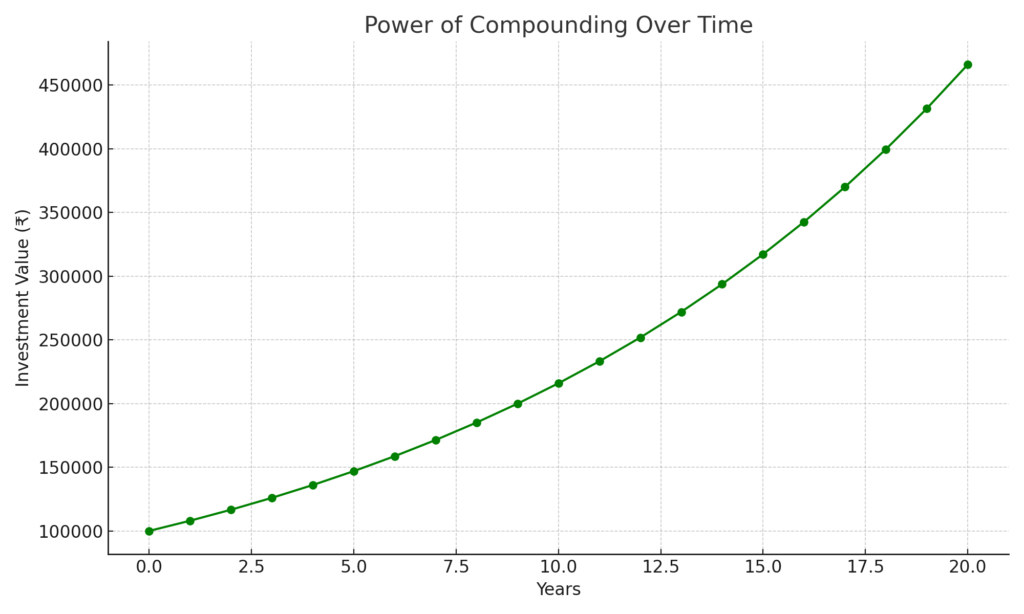

4. Invest Consistently

Time in the market is more important than timing the market. Invest regularly in low-cost diversified instruments such as mutual funds, index funds, or ETFs. Consider tax-efficient options like EPF, PPF, and the National Pension Scheme (NPS).

5. Build an Emergency Fund

Aim to set aside 3–6 months of living expenses in a separate high-interest savings account or liquid mutual fund. This ensures quick access to funds during emergencies such as job loss or medical events.

Setting Financial Goals

Define both short-term and long-term financial goals with realistic timelines. This clarity aids disciplined savings and investment planning.

Comparison of Investment Goals

| Parameter | Short-Term Goals | Long-Term Goals |

| Time Horizon | 1–3 years | 3 years and above |

| Examples | Vacation, Gadget, Emergency Fund | Retirement, Home Purchase, Education |

| Risk Appetite | Low | Moderate to High |

| Preferred Instruments | High-yield savings, Liquid mutual funds, T-Bills | Stocks, Mutual Funds, PPF, Real Estate, ETFs |

| Objective | Liquidity, Capital Preservation | Wealth Creation, Long-Term Growth |

Final Thoughts

Consistent and disciplined financial decisions, even small ones, compound over time to create long-term wealth and financial security. Start early, stay committed, and make financial prudence a habit.

Disclaimer: This document is for informational purposes only and should not be construed as financial advice. Please consult us for more personalized guidance.

Author

Mrs. Sudha Indukuri

Intern

Pavan Goyal and Associates (Chartered Accountants)

Office No. B212, GO Square, Mankar Chowk, Wakad, Pune 411057

Email – office@goyalca.com

Contact – 9762763351